[ad_1]

Venture Genesis is a brand new initiative from the Financial institution for Worldwide Settlements (BIS) Innovation Hub and the Hong Kong Financial Authority (HKMA) to encourage sustainable funding by tokenizing inexperienced bonds. The hope is that it will make bonds extra accessible, with smaller investments required. Moreover, it goals to show the sustainability claims that underpin the bonds.

“Inexperienced and digital aren’t solely interconnected however interdependent – the destiny of 1 depends upon the opposite. Inexperienced finance, accordingly, is a key precedence of the BIS Innovation Hub and Genesis is an integral a part of that,” mentioned Benoît Cœuré, Head of the BIS Innovation Hub.

The venture will goal the complete bond life cycle. In different phrases, the issuance course of, cost of curiosity and redemption. There are two parallel tracks, one on a number of permissioned blockchains, operated by Digital Asset (Switzerland) and its companion GFT Applied sciences Hong Kong. The second observe is the Liberty Consortium which can use a public permissionless blockchain. Consortium members embrace SC Ventures, Normal Chartered Financial institution and Shareable Asset.

On the identical time, Hong Kong’s Allinfra can be answerable for utilizing blockchain to confirm the sustainable use circumstances.

There’s been a substantial upswing in inexperienced bond exercise since 2015. And within the final 18 months, there’s been a considerable enhance in bulletins for initiatives utilizing blockchain and tokenization for sustainable functions.

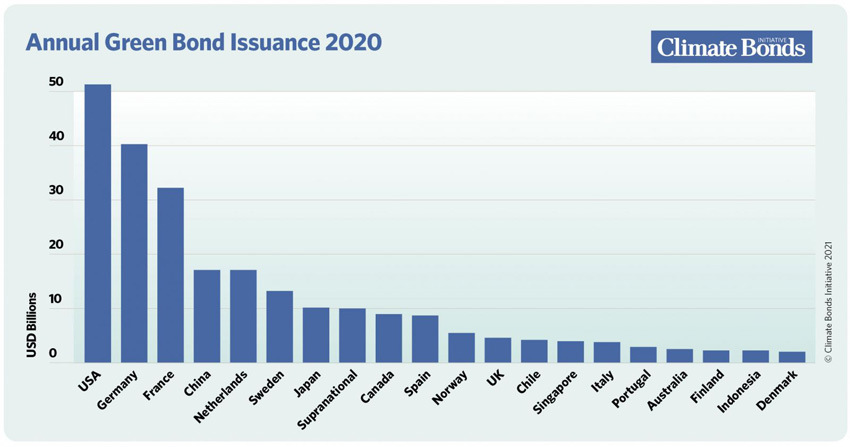

2020 was a record year for green bond issuance at $269.5 billion regardless of the pandemic, a determine marginally greater than 2019. The cumulative determine for issuance handed the one trillion greenback mark for the primary time. That’s lower than one % of the worldwide bond market of $123.5 trillion on the finish of 2020.

The USA issued probably the most at $51 billion, much like 2019, however China fell from second to fourth place, maybe associated to the pandemic. However it’s additionally eyeing blockchain for inexperienced bonds.

In the meantime, in 2019, HSBC and Sustainable Digital Finance Alliance (SDFA) revealed a whitepaper on blockchain for inexperienced bonds. A couple of issuances have used DLT, together with from German engineering agency Dürr and BBVA was concerned with two issuances for MAPFRE and a sustainable “Schuldschein” mortgage for the Madrid Government.

[ad_2]

Source link